Glossary

GLOSSARY OF ISLAMIC FINANCIAL TERMS

Al Ajr

A commission, fees or wages levied for services.

Amana/Amanah

Reliability or trustworthiness. Important value of Islamic society in mutual dealings. It also refers to deposits in trust. A person may hold property in trust for another, sometimes by implication of a contract.

Al Wadia

Absolute power of attorney.

Al Rahn Al

Arrangement where a valuable asset is placed as a collateral for a debt. The collateral is disposable in the event of a default. Pawn Broking.

Al Wadiah

Safe keeping.

Awkaf/Awqaf

A religious foundation set up to assist the poor and needy.

Bai Muajjal (Deferred Payment Contract)

A contract involving the sale of goods on a deferred payment basis. The bank or provider of capital buys the goods (assets) on behalf of the business owner. The bank then sells the goods to the client at an agreed price, which will include a mark-up since the bank needs to make a profit. The business owner can pay the total balance at an agreed future date or pay by installments over a pre-agreed period. This is similar to a Murabaha contract since it is also a credit sale.

Bai al Dayn Debt financing: the provision of financial resources required for production, commerce and services by way of sale/purchase of trade documents and papers. Bai al-Dayn is a short-term facility with a maturity of not more than a year. Only documents evidencing debts arising from bona fide commercial transactions can be traded.

Bai al Salam This term refers to advance payment for goods which are to be delivered later. Normally, no sale can be effected unless the goods are in existence at the time of the bargain. But this type of sale forms an exception to the general rule provided the goods are defined and the date of delivery is fixed. One of the conditions of this type of contract is advance payment; the parties cannot reserve their option of rescinding it but the option of revoking it on account of a defect in the subject matter is allowed. It is usually applied in the agricultural sector where the bank advances money for various inputs to receive a share in the crop, which the bank sells in the market.

Baitul Mal

Treasury.

Fatwah

A religious decree.

Fiqh

Islamic jurisprudence. The science of the Shariah. It is an important source of Islamic economics.

Gharar Lit

Uncertainty, hazard, chance or risk. Technically, sale of a thing which is not present at hand; or the sale of a thing whose consequence or outcome is not known; or a sale involving risk or hazard in which one does not know whether it will come to be or not, such as fish in water or a bird in the air. Deception through ignorance by one or more parties to a contract. There are several types of gharar, all of which are haram. The following are some examples:

- Selling goods that the seller is unable to deliver

- Selling known or unknown goods against an unknown price

- Selling goods without proper description

- Selling goods without specifying the price

- Making a contract conditional on an unknown event

- Selling goods on the basis of false description

Selling goods without allowing the buyer to properly examine the goods

The root Gharar denotes deception. Bay' al-Gharar is an exchange in which there is an element of deception either through ignorance of the goods, the price, or through faulty description of the goods. Bay' al-Gharar is an exchange in which one or both parties stand to be deceived through ignorance of an essential element of exchange. Gambling is a form of Gharar because the gambler is ignorant of the result of his gamble.

Halal

That which is permissible. In Islam there are activities, professions, contracts and transactions which are explicitly prohibited (haram) by the Qur'an or the Sunnah. Barring them, all other activities, professions, contracts, and transactions etc. are halal. An activity may be economically sound but may not be allowed in the Islamic society if it is not permitted by the Shari'ah.

Hawala

Lit: bill of exchange, promissory note, cheque or draft. Technically, a debtor passes on the responsibility of payment of his debt to a third party who owes the former as debt. Thus the responsibility of payment is ultimately shifted to a third party. Hawala is a mechanism for settling international accounts, by book transfers.

Haram

Unlawful.

Haram

Unlawful.

Ijara (Leasing)

A contract where the bank or financier buys and leases equipment or other assets to the business owner for a fee. The duration of the lease as well as the fee are set in advance. The bank remains the owner of the assets. This type of contract is a classical Islamic financial product. Leasing is also a lawful method of earning income, according to Islamic law. In this method, tangible assets such as machinery, a car, a ship, a house, can be leased by one person (lessor) to the other (lessee) for a specific period against a specific price. The benefit and cost of the each party are to be clearly spelled out in the contract so that any ambiguity (Gharar) may be avoided.

Ijarah wa Iqtina (Lease to Purchase)

This term refers to a mode of financing adopted by Islamic banks. It is a contract under which the Islamic bank finances equipment, a building or other facility for the client against an agreed rental together with an undertaking from the client to purchase the equipment or the facility. The rental as well as the purchase price is fixed in such a manner that the bank gets back its principal sum along with some profit which is usually determined in advance.

Ijtehad

Lit: effort, exertion, industry, diligence. Technically, endeavor of a jurist to derive or formulate a rule of law on the basis of evidence found in the sources.

Istisna (Progressive Financing)

A contract of acquisition of goods by specification or order where the price is paid progressively in accordance with the progress of a job. An example would be for the purchase of a house to be constructed, payments are made to the developer or builder according to the stage of work completed. This type of financing along with bai salam are used as purchasing mechanisms, and murabaha and bai muajjal are for financing sales.

Ju'alal

Lit: stipulated price for performing any service. Technically applied in the model of Islamic banking by some. Bank charges and commission have been interpreted to be ju'ala by the jurists and thus considered lawful.

Mudaraba / Modaraba (Trust Financing)

The term refers to a form of business contract in which one party brings capital and the other personal effort. The proportionate share in profit is determined by mutual agreement. But the loss, if any, is borne only by the owner of the capital, in which case the entrepreneur gets nothing for his labour. The financier is known as 'rab-al-maal' and the entrepreneur as 'mudarib'. Mudarib In a mudaraba contract, the person or party who acts as entrepreneur.

Mu'amalah(t)

Lit: economic transaction

Murabaha / Morabaha (Cost-Plus Financing)

Lit: sale on profit. Technically a contract of sale in which the seller declares his cost and profit. This has been adopted as a mode of financing by a number of Islamic banks. As a financing technique, it involves a request by the client to the bank to purchase a certain item for him. The bank does that for a definite profit over the cost which is agreed in advance. It has been estimated that 80 to 90 percent of financial operations of some Islamic banks belong to this category. There are a number of requirements for this transaction to meet the Islamic standards of a legal sale. The entire transaction is to be completed in two stages and as two separate contracts. In the first stage, the client requests the bank to undertake a Murabaha transaction and promises to buy the commodity specified by him, if the bank acquires the same commodity. In the second stage, the client purchases the good acquired by the bank on a deferred payments basis and agrees to a payment schedule. The Murabaha form of financing is being widely used by the Islamic banks to satisfy various kinds of financing requirements. It is used to provide finance in various and diverse sectors e. g. in consumer finance for purchase of consumer durable such as cars and household appliances, in real estate to provide housing finance, in the production sector to finance the purchase of machinery, equipment and raw material etc.

Musharaka (Venture Capital)

Musharaka is a technique of financing used as a partnership. It is where two or more financiers provide finance for a project. All partners are entitled to a share in the profits resulting from the project in a ratio which is mutually agreed upon. However, the losses, if any, are to be shared exactly in the proportion of capital proportion. All partners have a right to participate in the management of the project. However, they can waive the right of participation in favour of any specific partner or person. There are two main forms of Musharaka: Permanent Musharaka and Diminishing Musharaka. These are briefly explained below:

Musharaka (Venture Capital)

Musharaka is a technique of financing used as a partnership. It is where two or more financiers provide finance for a project. All partners are entitled to a share in the profits resulting from the project in a ratio which is mutually agreed upon. However, the losses, if any, are to be shared exactly in the proportion of capital proportion. All partners have a right to participate in the management of the project. However, they can waive the right of participation in favour of any specific partner or person. There are two main forms of Musharaka: Permanent Musharaka and Diminishing Musharaka. These are briefly explained below:

Permanent Musharaka - In this form of Musharaka an Islamic bank participates in the equity of a project and receives a share of profit on a pro rata basis. The period of contract is not specified. So it can continue so long as the parties concerned wish it to continue. This technique is suitable for financing projects on a longer term where funds are committed over a long period and gestation period of the project may also be protracted

Diminishing Musharaka - Diminishing Musharaka allows equity participation and sharing of profit on a pro rata basis but also provides a method through which the equity of the bank keeps on reducing its equity in the project and ultimately transfers the ownership of the asset on of the participants. The contract provides for a payment over and above the bank share in the profit for the equity of the project held by the bank. That is the bank gets a dividend on its equity. At the same time the entrepreneur purchases some of its equity. Thus, the equity held by the bank is progressively reduced. After a certain time the equity held by the bank shall come to zero and it shall cease to be a partner. Musharaka form of financing is being increasingly used by the Islamic banks to finance domestic trade, imports and to issue letters of credit.

Musaqah

A contract in which the owner of the garden shares its produce with another person in return for his services in irrigating the garden.

Muzara'a

A contract in which one person agrees to till the land of the other person in return for a part of the produce of the land.

Qard Hasan (Interest free loans

Most of the Islamic banks also provide interest free loans (Qard Hasan) to their customers. If this practice is not possible on a significant scale, even then, it is adopted at least to cover some needy people. Islamic view about loan (Qard) is that it should be given to borrower free of charge.

Qimer

Lit: gambling. Technically, an agreement in which possession of a property is contingent upon the occurrence of an uncertain event. By implication it applies to those agreements in which there is a definite loss for one party and definite gain for the other without specifying which party will gain and which party will lose.

Rab-al-maal

In a mudaraba contract the person who invests the capital

Riba

This term literally means an increase or addition. Technically it denotes any increase or advantage obtained by the lender as a condition of the loan. Any risk-free or "guaranteed" rate of return on a loan or investment is riba. Riba, in all forms, is prohibited in Islam. In conventional terms, riba and "interest" are used interchangeably.

Sadaqah

Charitable giving.

Shariah / Sharia / Shari'a

Islamic canon law derived from 3 Primary sources: the Quran; the Hadith (sayings of the Prophet Muhammad); and the Sunnah (practice and traditions of the Prophet Muhammad), and three Secondary sources Qiyas (Analogical deductions and reasoning), Ijma (Consensus of Islamic Scholars) and Ijtihad (Legal reasoning).

Shirkah

A contract between two or more persons who launch a business or financial enterprise to make profit. Shirka = musharaka.

Suftajal

A banking instrument used for the delegation of credit and was used to collect taxes, disburse government dues and transfer funds by merchants. In some cases suftajahs were payable at a future fixed date and in other cases they were payable on sight. Suftajah is distinct from the modem bill of exchange in some respects. Firstly, a sum of money transferred by suftajah had to keep its identity and payment had to be made in the same currency. Exchange of currencies could not take place in this case. Secondly, Suftajah usually involved three persons. 'A' pays a certain sum of money to 'B' for agreeing to give an order to 'C' to pay back to 'A'. Third, a Suftajahs could be endorsed.

Sukuk

A certificate entitling the holder to the benefits of the income stream of the assets backing the certificate. Equivalent to a Fixed income bond.

Takaful

This is a form of Islamic insurance based on the Quranic principle of Ta'awon or mutual assistance. It provides mutual protection of assets and property and offers joint risk sharing in the event of a loss by one of its members. Takaful is similar to mutual insurance in that members are the insurers as well as the insured. Conventional insurance is prohibited in Islam because its dealings contain several haram elements including gharar and riba, as mentioned above.

Waqf

Lit: detention. Technically appropriation or tying-up of a property in perpetuity so that no propriety rights can be exercised over the usufruct. The Waqf property can neither be sold nor inherited or donated to anyone. Awqaf consists of religious foundations set up for the benefit of the poor.

Zakah/Zakat

A tax which is prescribed by Islam on all persons having wealth above an exemption limit at a rate fixed by the Shariah. According to the Islamic belief Zakah purifies wealth and souls. The objective is to take away a part of the wealth of the well-to-do and to distribute it among the poor and the needy. It is levied on cash, cattle, agricultural produce, minerals, capital invested in industry, and business etc. The distribution of Zakah fund has been laid down in the Qur'an (9:60) and is for the poor, the needy, Zakah collectors, new converts to Islam, travellers in difficulty, captives and debtors etc. It is payable if the owner is a Muslim and sane. Zakah is the third pillar of Islam. It is an obligatory contribution which every well-off Muslim is required to pay to the Islamic state, in the absence of which individuals are required to distribute the Zakah among the poor and the needy as prescribed by the Shariah.

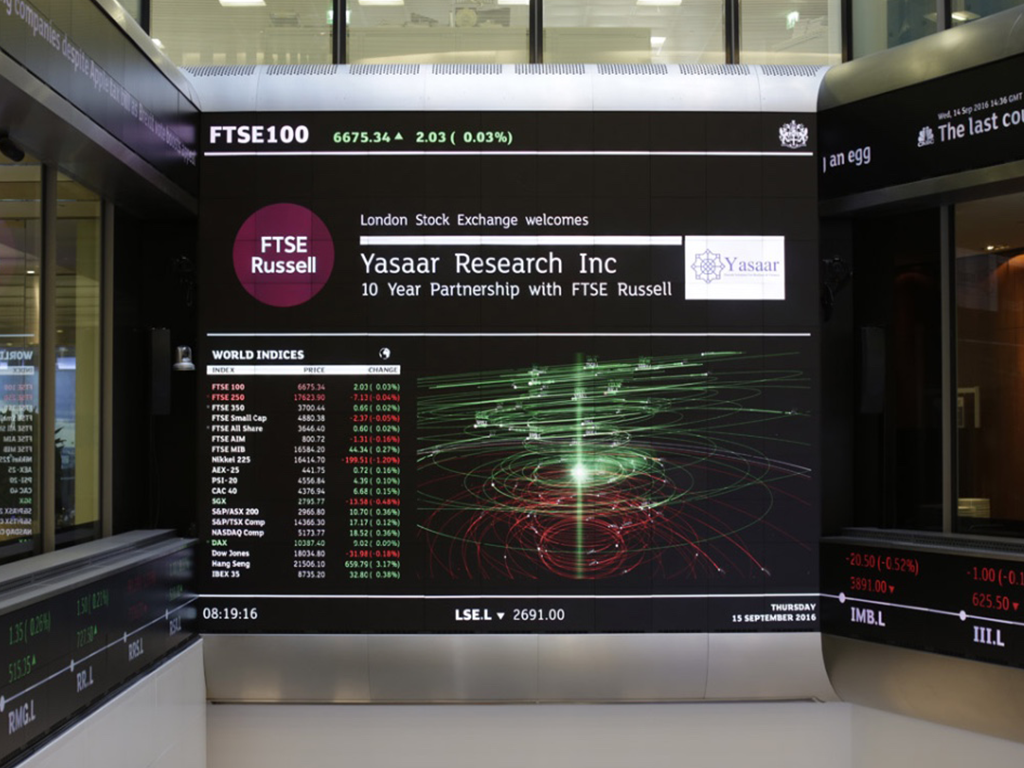

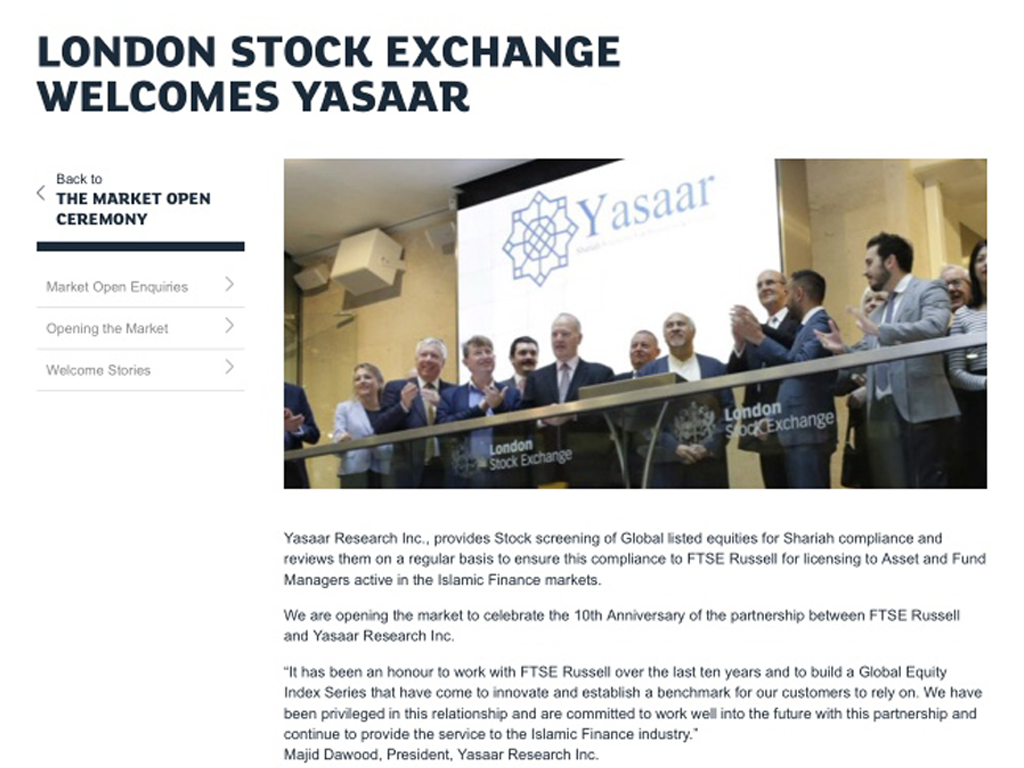

FTSE RUSSELL

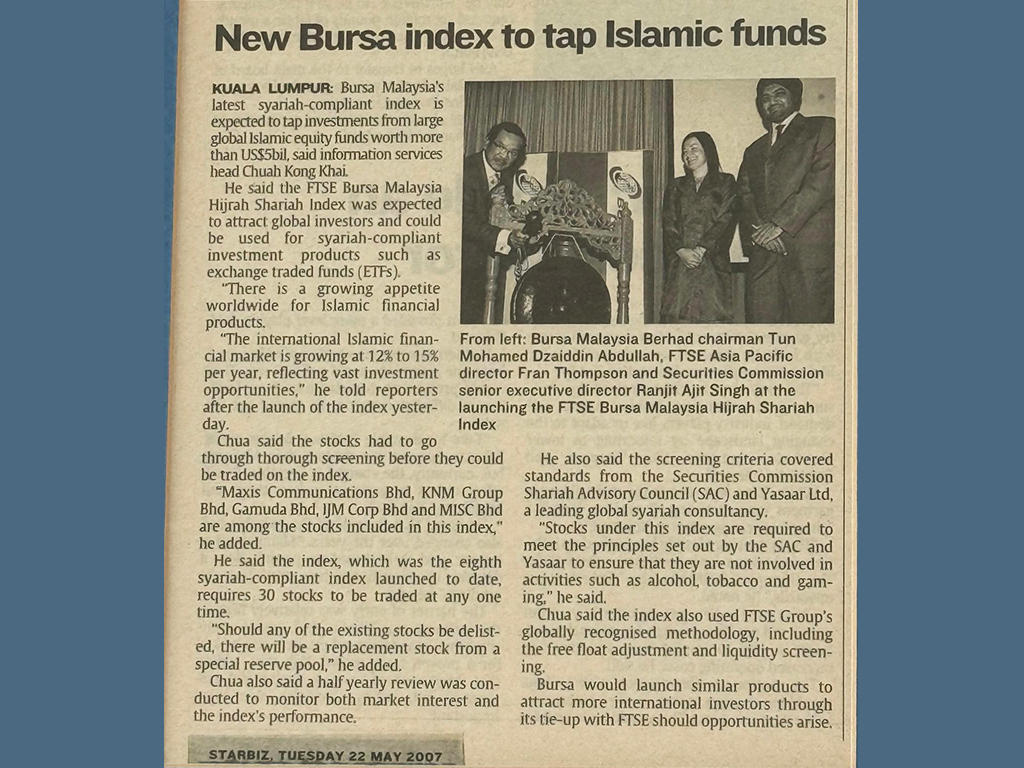

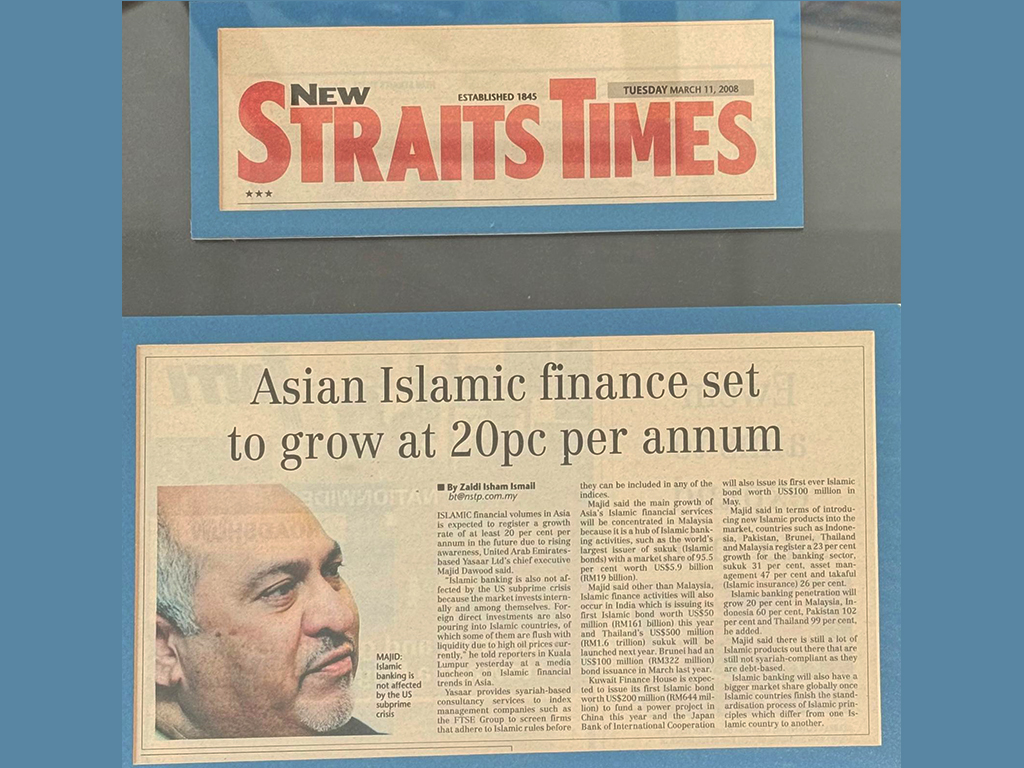

The partnership between FTSE and Yasaar brings together FTSE’s global expertise in creating financial benchmarks & indices and Yasaar’s deep knowledge of Shariah-compliant finance. Together, since 2006, they developed the FTSE Yasaar Global Shariah Index Series, offering a comprehensive range of benchmarks tailored for Islamic investors. By combining FTSE’s robust governance processes with Yasaar’s screening and independent Shariah Board, the partnership ensures that each index adheres strictly to Shariah principles while maintaining market relevance. This collaboration supports the growing demand for ethical investments in accordance with Islamic finance guidelines across global markets.

FTSE RUSSELL

The partnership between FTSE and Yasaar brings together FTSE’s global expertise in creating financial benchmarks & indices and Yasaar’s deep knowledge of Shariah-compliant finance. Together, since 2006, they developed the FTSE Yasaar Global Shariah Index Series, offering a comprehensive range of benchmarks tailored for Islamic investors. By combining FTSE’s robust governance processes with Yasaar’s screening and independent Shariah Board, the partnership ensures that each index adheres strictly to Shariah principles while maintaining market relevance. This collaboration supports the growing demand for ethical investments in accordance with Islamic finance guidelines across global markets.

Global Relief Trust

Global Relief Trust is a Leading Muslim Charity based in the United Kingdom, working across the globe. Giving charity is one of the best deeds we can fulfil, gaining an immense amount of reward. You can provide vulnerable families with much needed aid.

Global Relief Trust

Global Relief Trust is a Leading Muslim Charity based in the United Kingdom, working across the globe. Giving charity is one of the best deeds we can fulfil, gaining an immense amount of reward. You can provide vulnerable families with much needed aid.

UKIFC

Yasaar and the Islamic Finance Council UK (UKIFC) share a commitment to advancing the integration of sustainability within the Islamic finance sector.

UKIFC

Yasaar and the Islamic Finance Council UK (UKIFC) share a commitment to advancing the integration of sustainability within the Islamic finance sector.